The 4 Things You Need for a Tech Bubble

The chatter is everywhere, from Wall Street trading floors to Silicon Valley boardrooms: Are we in the midst of a colossal AI bubble? The question has gained urgency as tech behemoths like Google, Meta, and Microsoft double down on their AI strategies, earmarking staggering sums for 2026 and beyond. This year alone, Big Tech is on a trajectory to spend a jaw-dropping $400 billion on artificial intelligence, a figure that continues to climb.

The hype reached a fever pitch when chipmaker Nvidia shattered records, becoming the world’s first $5 trillion company. To put that into perspective, its valuation is more than double the entire Canadian economy. OpenAI’s Sam Altman has casually floated the possibility of an AI bubble, and even Bill Gates has weighed in, acknowledging that while we are in a bubble, he believes “something profound” will emerge from it, much like the internet did from the dot-com era.

Yet, a shadow looms over this unprecedented spending spree. A recent report revealed a startling disconnect between investment and return:

According to some reports, 95 percent of businesses currently using AI say that they’re seeing little to no return on their investment.

This disparity fuels the debate: Is the AI boom a sustainable revolution or an economic bubble inflated by hype and speculation, destined to burst? To navigate this complex landscape, we can turn to a historical framework developed by researchers to identify the classic signs of an economic bubble and understand what it all means for our future.

What Exactly Is a Tech Bubble?

Before dissecting the current AI frenzy, it’s crucial to define what a “bubble” truly is. Some purist economists might argue that bubbles don’t exist, but for most, the concept is well-understood. In its simplest form, an economic bubble occurs when the level of investment in a technology, company, or commodity dramatically outpaces its intrinsic value and potential for future returns.

Think back to the dot-com era. Companies like Pets.com attracted immense venture capital and public investment based on the promise of the internet, not on solid revenue or profit. At its peak, a company like Toys.com was valued far higher than the established brick-and-mortar giant Toys “R” Us, despite having a fraction of its sales. When these companies inevitably failed to generate the profits investors expected, their stock prices plummeted, and the bubble burst. Investors who poured money in at the peak never saw a return.

The fear today is that history is repeating itself on a gargantuan scale. With trillions of dollars flowing into AI infrastructure, chip manufacturing, and model development, the central question is whether this technology can ever generate enough revenue to justify the colossal investment. If not, the resulting collapse could dwarf anything we’ve seen before.

A Framework for Identifying Bubbles

To move beyond “vibes-based” commentary, two scholars, Brent Goldfarb and David Kirsch, provide a more methodical approach. In their book, Bubbles and Crashes: the Boom and Bust of Technological Innovation, they analyzed historical tech booms to identify the common factors that push a period of high investment into full-blown bubble territory.

Their research identified four key ingredients that, when present, create the perfect conditions for a tech bubble. By applying this framework to the current AI landscape, we can gain a clearer picture of the risks we face.

| Factor | Description | AI Application |

|---|---|---|

| 1. Uncertainty in Innovation | It’s unclear how a new, game-changing technology will generate profit or what its primary business model will be. | The exact path to profitability for generative AI remains largely theoretical, with many core services still costing more to run than they generate in revenue. |

| 2. Pure-Play Investments | The presence of companies whose entire business model and financial fate are inextricably tied to the success of the new technology. | Companies like Nvidia and CoreWeave are now almost entirely dependent on the continued expansion of the AI industry for their massive valuations. |

| 3. Novice Investors | Retail, or non-expert, investors have easy access to investment vehicles, allowing them to pour money into the new innovation. | Apps like Robinhood have democratized stock trading, enabling anyone to invest in AI-related companies like Nvidia with just a few taps. |

| 4. A Coordinating Belief | A powerful, shared narrative or story among investors that a particular innovation is the undisputed future, often sparked by a compelling real-world demo. | The viral launch of ChatGPT created a powerful, unified belief that AI will automate everything, cure diseases, and reshape society, driving investment mania. |

Let’s break down each of these factors in the context of the current AI boom.

Factor 1: The Fog of Uncertainty

Every transformative technology begins its life shrouded in uncertainty. When electricity and the electric light bulb first appeared in the 19th century, it was obvious they were game-changers. Cities erected massive, sparking light towers, demonstrating the raw power of the innovation. However, it was far from clear how this technology would become a profitable business. Would the primary market be municipalities lighting streets, or individual consumers buying light bulbs for their homes? It took decades to sort out the infrastructure, pricing, and business models.

Similarly, when broadcast radio emerged, everyone knew it was revolutionary, but no one was sure how to monetize it. Would it be a marketing tool? A platform for broadcasting plays? This uncertainty fueled a massive investment bubble in the 1920s.

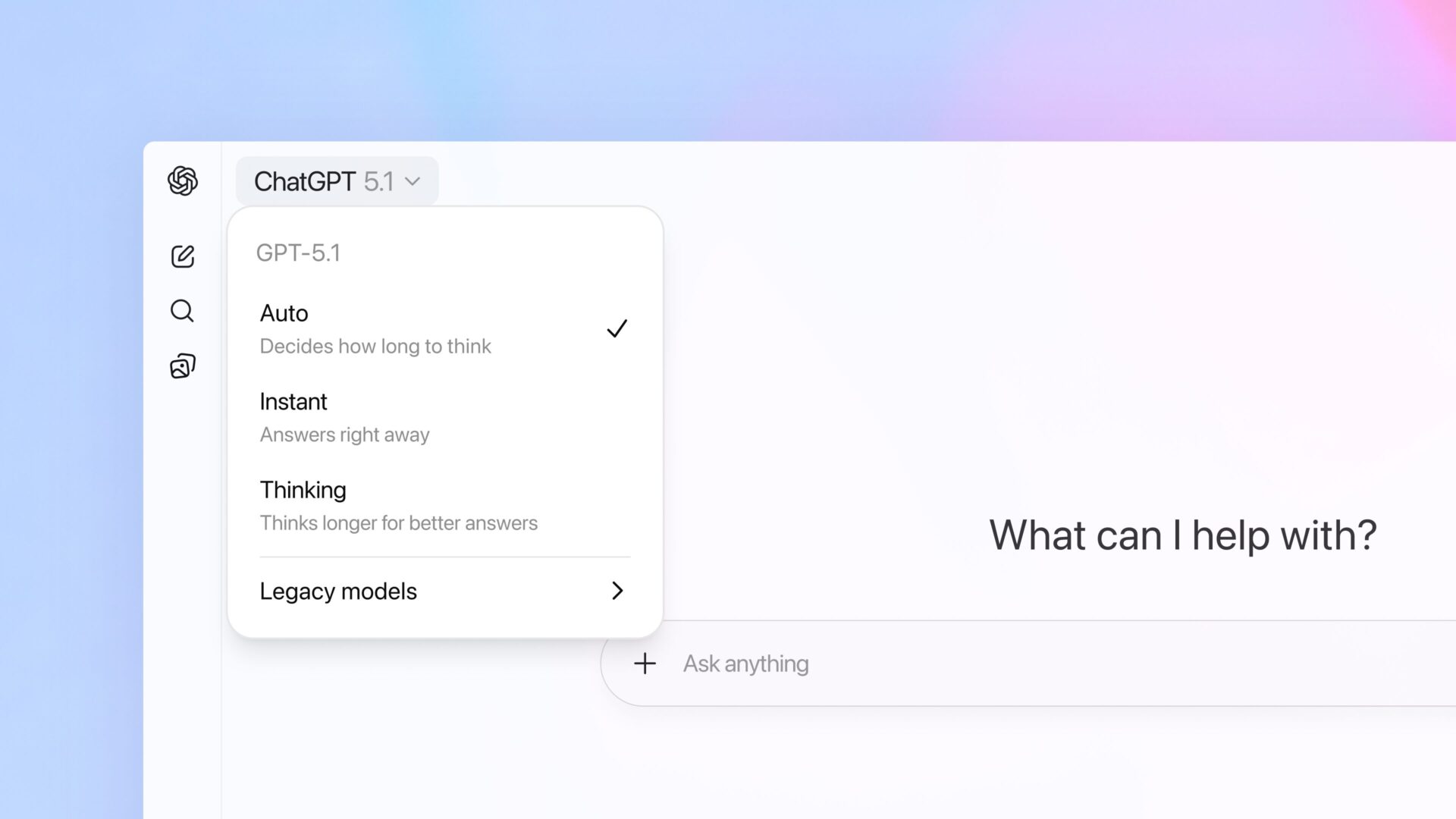

Today, AI is in the same boat. We have a powerful, awe-inspiring technology, but the path to sustainable profitability is murky at best.

- Chatbots are immensely popular, but running them is incredibly expensive due to the massive computational power they require.

- Companies are integrating AI into their workflows, but as the data shows, most are not yet seeing a positive return on investment.

- Even the leaders of the AI revolution have expressed this uncertainty. Years ago, when asked how OpenAI would make money, Sam Altman famously replied, “We’re going to build AGI and we’re going to ask it.”

While a seemingly flippant comment, it reveals the profound uncertainty at the heart of the industry. The business plan is to first create a superintelligence and then figure out the monetization. This level of ambiguity is a classic hallmark of a forming bubble.

Factor 2: The Rise of Pure-Play Investments

A “pure-play” company is one whose fate rises and falls entirely with a single innovation. If the technology succeeds, the company soars; if it fails, the company is likely to disappear. The dot-com bust was littered with the corpses of pure-play e-commerce companies.

In the AI era, Nvidia has effectively become the ultimate pure-play investment. While many remember Nvidia as a company that made graphical processing units (GPUs) for the gaming industry, it has completely pivoted its business to supply the specialized chips that are the lifeblood of the AI revolution. It has become the premier “seller of shovels during the gold rush.” For investors, buying Nvidia stock is the most tangible and direct way to bet on the AI boom. Its fate is now almost entirely tied to the continued, exponential growth of AI data centers and models.

While there haven’t been as many AI IPOs as one might expect, other pure-plays have emerged, like CoreWeave, which provides specialized cloud infrastructure for AI. The AI boom is unique in that investment is highly concentrated in a handful of these critical companies. This concentration creates systemic risk. Because Nvidia now constitutes a significant portion of the entire stock market—around 8% by some measures—a downturn in its fortunes wouldn’t just affect tech investors; it would send shockwaves through the entire global economy, impacting pension funds and diversified portfolios alike.

Factor 3: The Influence of Novice Investors

For a bubble to truly inflate, it needs participation from the broader public. The dot-com boom was famously fueled by retail investors—everyday people who, after reading about the internet’s promise, plowed their life savings into newly public tech companies they barely understood.

Today, that dynamic is amplified. With commission-free trading apps like Robinhood, anyone with a smartphone can become a day trader. The barrier to entry has never been lower, allowing a new generation of novice investors to pour money into hot stocks like Nvidia, often driven by social media trends rather than fundamental analysis.

However, the AI bubble has an interesting twist on this factor. As analyst Brent Goldfarb notes, the sheer uncertainty and complexity of artificial intelligence effectively turn everyone into a novice investor. Even the most seasoned venture capitalists and institutional fund managers are operating in uncharted territory. Nobody truly knows what the future holds, what the ultimate applications will be, or which companies will survive in the long run. In this environment, multi-billion-dollar investment decisions are being made with the same level of speculative faith as a retail investor buying a few shares on their phone. This universal “novice” status across the board makes the market even more susceptible to herd mentality and narrative-driven hype.

Factor 4: The Power of a Coordinating Belief

The final, and perhaps most crucial, ingredient is a compelling, unifying narrative—what Goldfarb and Kirsch call a “coordinating belief.” This is a story so powerful that it aligns investors, industry leaders, and the public in a shared conviction that a technology is the future.

Historically, these beliefs are often cemented by a spectacular real-world demonstration. When Charles Lindbergh successfully completed his transatlantic flight in 1927, it was arguably the greatest tech demo in history up to that point. It proved the viability of aviation and ignited a speculative frenzy, leading to an aviation bubble.

For AI, the “Lindbergh moment” was the public release of ChatGPT. It went viral almost overnight, demonstrating its capabilities to millions of people in a tangible, interactive way. This single event crystallized the coordinating belief around AI. The story is no longer just about smarter software; it’s a narrative of limitless potential.

The promise of AI is the story to end all stories:

- It will automate every job, ushering in an era of unprecedented productivity.

- It will cure cancer and solve the most complex challenges in medicine.

- It will combat climate change by optimizing energy grids and discovering new materials.

- It will ultimately lead to Artificial General Intelligence (AGI), a machine that can do anything a human can do, and more.

This grand, all-encompassing narrative offers something for every investor and every industry. It’s the promise of a “do-literally-everything machine.” This belief is so powerful that it compels companies to invest billions, not just out of optimism, but out of a fear of being left behind if the incredible promises turn out to be true.

The Verdict: Are We in an AI Bubble?

When Goldfarb and Kirsch were asked to apply their framework to the current state of AI, their conclusion was unequivocal. On their 0-to-8 scale of bubble risk, they gave AI a resounding 8 out of 8. All the ingredients are present in large quantities, signaling a maximum-level bubble alert.

It’s important to note that their framework is designed to identify the presence of a bubble, not to predict the scale of its collapse or the exact timing. However, the analysis suggests that the current market dynamics are historically consistent with past technological bubbles that ended in a crash. The sheer scale of the capital involved suggests that if this bubble bursts, the economic fallout could be far more severe than the dot-com crash of the early 2000s.

If the Bubble Bursts, What Happens Next?

Even the fiercest critics of the AI hype don’t believe the technology will simply vanish if the bubble pops. After the dot-com crash, the internet didn’t go away; in fact, the over-investment in fiber-optic cables laid the groundwork for the broadband era and the rise of companies like Google, Amazon, and Netflix.

A similar outcome is possible for AI. A market correction could wipe out trillions in paper wealth and lead to significant economic pain, but the underlying utility of the technology would persist. The companies that survive will be those that find a truly sustainable business model.

However, there’s a key difference between the dot-com infrastructure and the AI infrastructure. The fiber-optic cables laid in the 90s are still in use today. In contrast, the AI chips being produced by Nvidia are on a rapid upgrade cycle. The cutting-edge chips of today may be largely obsolete in five to ten years, meaning the massive capital expenditure on current hardware may not have the same long-term residual value.

Ultimately, the most enduring legacy of this AI boom may not be a new foundational infrastructure like electricity or the internet, but rather its influence on content and labor. AI has proven to be an incredibly powerful tool for generating content—from text and images to code and video. It is also being positioned as a powerful tool for reducing labor costs. These applications will likely persist and permanently reshape our economy, but they may not be the world-transforming, universally beneficial applications promised by the grand narrative.

Can This Bubble Be Sustained?

Is there a future where the bubble doesn’t burst but simply deflates slowly, or is even sustained? We are in a unique historical moment. Unlike in previous eras, governments are now playing a much more active role in the tech economy. The US administration, for example, is a vocal proponent of AI and has taken the unprecedented step of acquiring a stake in a chipmaker like Intel.

This raises a novel possibility: if the AI bubble begins to show signs of a catastrophic burst, we might see direct government intervention. An administration could decide that the industry is “too big to fail” and step in to prop up key firms, buy stakes in companies, or provide subsidies to prevent a total collapse. This would be an unprecedented development, moving us into a new era where the state becomes a direct partner in an industry born from speculative investment.

The path forward is anything but certain. The four classic signs of a tech bubble are flashing red, signaling extreme financial risk. Yet, the technology itself is undeniably powerful, and the political and economic landscape is unlike any we’ve seen before. Whether the AI boom leads to a historic crash or a managed transition into a new technological age, one thing is clear: we are living through a period of profound transformation, and the consequences will shape our world for decades to come.

Comments